The Report Cards of Wall Street

SEC filings are corporate report cards revealing everything from profits to fraud. Learn how to use edgartools to make these filings accessible and searchable with Python.

Everyone knows about SEC filings. Fewer people know how to search them efficiently. Even fewer can extract and analyze the data at scale. That's the gap worth closing.

What: The Corporate Report Card

Think of SEC filings as report cards for public companies - except instead of letter grades, they contain the financial health, major events, and business operations of companies traded on U.S. stock markets.

Your school report card showed grades in math, science, and English. SEC filings work the same way, but for companies: How much money did they make? What are executives paid? What could derail the business? Every risk factor, lawsuit, acquisition, leadership change, and bankruptcy gets documented. It's transparency by legal requirement - the full story, not just the highlights.

With this information, you can spot red flags before stock prices crash, identify undervalued companies others are missing, track what insiders are buying or selling, and make investment decisions based on facts instead of hype.

Better yet, you can access all of this data programmatically, search across thousands of filings, and extract structured data - not just read it on a website one filing at a time.

Why: The Real Reason Behind It All

SEC filings exist because of a painful lesson learned the hard way.

Before 1934, companies could say whatever they wanted about their finances. Investors had no way to verify claims. Fraud was rampant. The 1929 stock market crash and subsequent Great Depression taught America a brutal lesson: markets without transparency are casinos rigged against small investors.

The Securities Exchange Act of 1934 created the SEC and mandated regular disclosure. Here's what could go wrong without it - and how SEC filings protect your money:

The CEO Who Knows It's Over

August 14, 2001. Enron's CEO Jeffrey Skilling abruptly resigns after just six months, citing "personal reasons." The stock is trading around $40 and drops to $36 after the announcement. Behind the scenes, executives know the company is a house of cards built on accounting fraud.

Without Form 4 insider trading reports, you'd never know that Enron executives and board members were dumping hundreds of millions in stock while publicly expressing confidence. But the SEC filings told the story: Lou Pai sold $270 million in the 16 months before resigning. Ken Lay sold over $70 million back to the company. The paper trail was public - executives were legally required to disclose every share they sold within 2 business days.

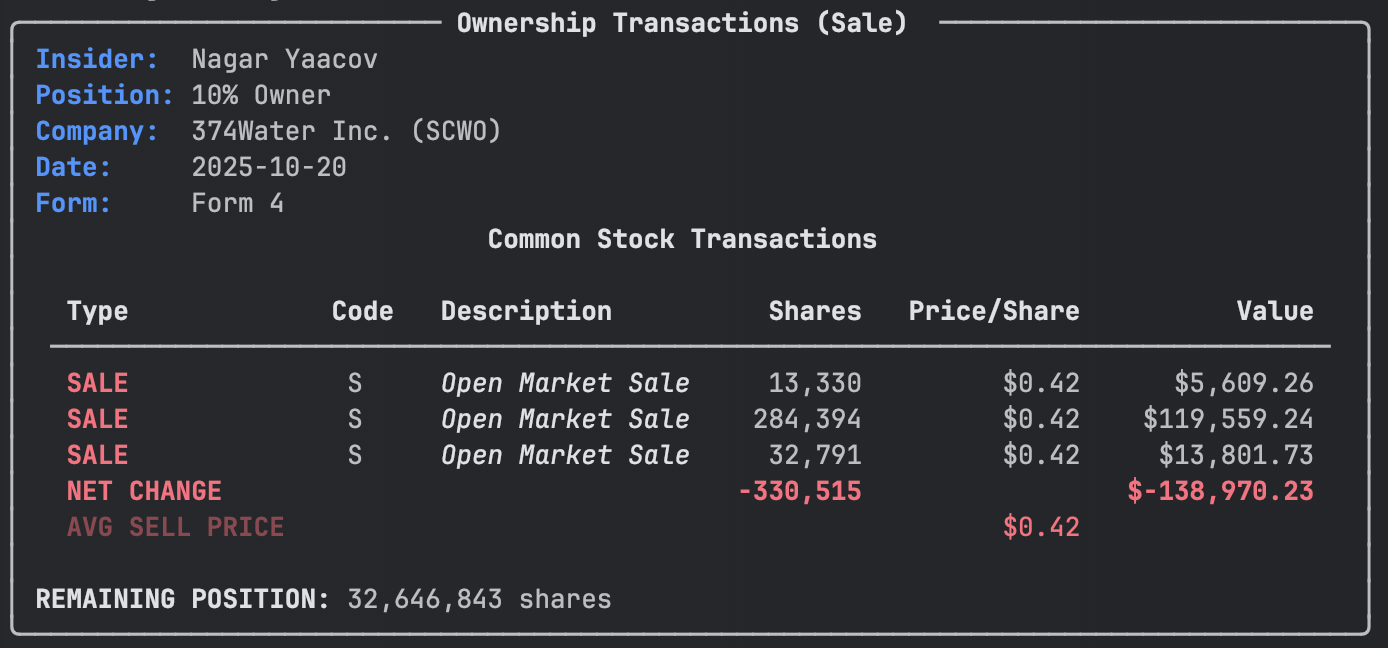

Today you can see these insider transactions and derive signals easily with edgartools.

filings = Company("SCWO").get_filings(form=4)

filings[0].obj()

The Company That Never Made Money

WeWork raised $12.8 billion claiming to revolutionize office space. Their pitch deck showed hockey-stick growth. But their S-1 filing in August 2019 told a different story: $1.9 billion in losses on $1.8 billion in revenue for 2018. They'd never made a profit. The more they grew, the more money they burned.

Investors could read the actual numbers. Within weeks, the IPO collapsed. The company was revalued from $47 billion in January 2019 to $8 billion by October - a $39 billion wipeout in less than a year.

Before mandatory disclosure, WeWork could have gone public on hype alone. You'd buy shares based on their marketing pitch, discovering the financial disaster only after your money was gone. The S-1 didn't stop WeWork from being overvalued - but it gave investors the data to call bullshit.

In the present day you can scan SEC for S-1 filings as they are released for gems to pick up or duds to avoid

s1_filings = get_current_filings(form="S-1")

The Surprise Bankruptcy No One Saw Coming

Lehman Brothers, September 15, 2008. The fourth-largest investment bank files for bankruptcy - the largest in U.S. history. The stock that traded at $86 in early 2007 closes at $0.21 the day of bankruptcy. Shareholders are wiped out.

But was it really a surprise? Their 10-Q filings showed leverage ratios climbing to 30:1 - meaning $680 billion in assets supported by only $22.5 billion in capital. Their 10-K disclosed massive subprime mortgage exposure - lending nearly 50 billion per month at the peak. The June 2008 10-Q reported a $2.8 billion loss. 8-K filings documented emergency capital raises of $6 billion.

The warning signs were public. Many investors didn't read them, but the information was there. Without mandatory quarterly and annual reports, Lehman could have hidden deteriorating fundamentals until the day they locked the doors. At least SEC filings gave sophisticated investors a chance to get out.

Following the Smart Money

Warren Buffett's Berkshire Hathaway bought 75 million shares of Apple between 2016 and 2018. How do we know? Form 13F - institutional investors managing over $100 million must disclose all U.S. stock holdings every quarter.

You can see exactly what Buffett, Ray Dalio, and Cathie Wood own. For free. Updated quarterly. Before the SEC, this information would be insider knowledge shared over golf games and private clubs. Now it's public data you can download.

Want to see what the world's best investors are buying? Check their 13F filings. It's not a guarantee of success - they can be wrong - but at least you're playing with the same information they have.

When: The Mandatory Schedule

Companies don't get to choose when to file - they follow strict deadlines enforced by the SEC. Think of it as a school calendar, but missing a deadline carries consequences far worse than detention.

The Regular Report Cards

Form 10-K is the comprehensive annual report, filed within 60-90 days after the fiscal year ends (larger companies get 60 days, smaller ones get 90). This is the full transcript - audited financials, complete risk disclosure, executive compensation, the works. Everything that happened in the past year gets documented.

Form 10-Q provides quarterly updates filed within 40-45 days after Q1, Q2, and Q3 end. Notice there's no Q4 quarterly report - that's because the annual 10-K covers the entire year. These are like progress reports: less comprehensive than the 10-K but detailed enough to spot trends and problems early.

Event-Driven Filings: When Something Happens

Form 8-K gets filed within 4 business days of material events. CEO resigned? File an 8-K. Completed a major acquisition? File an 8-K. Discovered accounting fraud? File an 8-K. These are breaking news alerts - leadership changes, financial bombshells, acquisitions, lawsuits, or anything else investors need to know immediately.

Form 4 tracks insider trading and must be filed within 2 business days when executives, directors, or 10%+ shareholders buy or sell company stock. If the CEO is dumping shares, this filing tells you. It's one of the most valuable real-time signals about what insiders think of their company's prospects.

Form 13F reveals institutional holdings quarterly. Investment managers controlling $100M+ must disclose all U.S. equity holdings within 45 days after quarter end. Want to see what Warren Buffett, Ray Dalio, or Cathie Wood bought last quarter? Check their 13F filings.

Who: The Players at the Table

Every SEC filing has a cast of characters with specific legal roles. Understanding who's who helps you interpret what you're reading.

The Filer

When you look at an SEC filing header, the first thing you'll see is FILED BY - this is the filer. In most cases, the filer is the company itself (the registrant) - the entity legally liable for the filing under the Securities Act of 1933 and Securities Exchange Act of 1934. Their CEO and CFO sign certifications and bear strict liability for any material misstatements or omissions.

But here's the twist: Sometimes the EDGAR filing header shows a filing agent as the filer - companies like Donnelley Financial Solutions, Toppan Merrill, or Workiva. These firms are hired to handle the technical submission: EDGAR formatting, XBRL tagging, and electronic filing.

Critical distinction: Filing agents are logistics experts, not content creators. They don't write the financial statements or business disclosures, and they bear no legal liability for the substance. The company (registrant) remains legally responsible.

Think of it this way: The company is the pilot who sets the course and is responsible for the flight. The filing agent is ground crew ensuring the plane is technically ready for takeoff. If the plane crashes due to pilot error, you don't sue the ground crew.

The filing header will tell you WHO filed it, but look at the actual REGISTRANT or COMPANY information in the filing to see who bears the legal responsibility.

The Subject Company

Sometimes the filer and the subject company are different. Take this real example from 1997, when Apple nearly went bankrupt. Saudi Prince Alwaleed Bin Talal invested $115 million and filed a 13D:

The SEC form header distinguishes these explicitly. This matters when you're tracking who's buying what - in this case, a major investor rescuing a struggling tech company that would eventually become the world's most valuable.

Co-Registrants: When Multiple Entities Share Responsibility

You'll often see co-registrants - multiple entities listed as joint filers. Common scenarios:

1. Parent-Subsidiary Debt Guarantees When a subsidiary guarantees parent company bonds, both register together:

Co-Registrant 2: Ford Motor Credit Company (guarantor)

Co-Registrant 3: Ford Holdings LLC (guarantor)

Investors need financials on ALL entities backing the debt.

2. Merger Filings When Disney acquires 21st Century Fox, both companies file joint proxy statements:

Co-Registrant 2: Twenty-First Century Fox, Inc.

Both shareholder bases vote, so both companies are responsible for disclosure.

3. Joint Venture Structures When Sony and Ericsson created a 50/50 mobile phone venture, both registered:

Co-Registrant 2: Ericsson AB

The Reporting Person vs. The Control Person

On ownership filings (Forms 3, 4, 5, 13D, 13G), you'll see:

Reporting Person: The entity or individual filing

Control Person: The individual who ultimately controls the shares

The SEC requires both to be disclosed because control matters more than technical ownership.

The Signatories: Skin in the Game

Every filing must be signed by people putting their necks on the line:

- CEO (Principal Executive Officer) - "I certify this is accurate"

- CFO (Principal Financial Officer) - "I verify these numbers"

- Board Directors (for 10-K annual reports) - "We reviewed and approve"

These signatures invoke criminal liability under Sarbanes-Oxley. That's why CFOs occasionally resign when they discover accounting problems - they refuse to sign.

The Auditor: The Independent Verifier

The independent registered public accounting firm (usually Big Four: Deloitte, PwC, EY, KPMG) audits the financial statements and issues an opinion. Their report lives in the 10-K and carries weight:

- Unqualified opinion: "These numbers are legit"

- Qualified opinion: "These numbers are mostly legit, but..."

- Adverse opinion: "These numbers are not reliable"

- Going concern warning: "This company might not survive the year"

An adverse opinion or going concern warning is a massive red flag.

The Group Filing: When Investors Act Together

When activist investors team up to pressure a company, they file as a group:

Group filings reveal coordination. If three hedge funds collectively own 15% and file together, management knows they're organizing.

Where: The EDGAR System

All SEC filings live in EDGAR (Electronic Data Gathering, Analysis, and Retrieval) - a massive free database containing millions of filings dating back to the 1990s.

Before EDGAR, you had to physically visit the SEC's office in Washington D.C. and photocopy paper filings. Now? Anyone with internet access can read Apple's 10-K from their phone.

The Main Characters: Filing Types

Different situations require different forms:

Gaining an advantage with edgartools

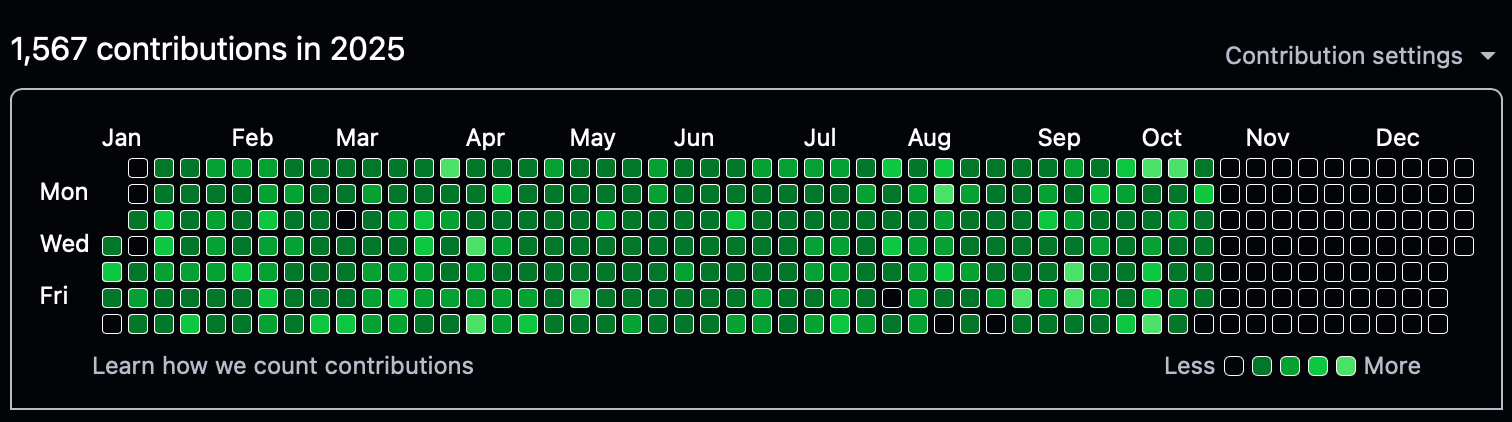

Edgartools has a lot of features for getting information and insight from SEC filings. I have spent a lot of time over the past 3 years adding features that map to Edgar but make it easier to use. I was shocked when I looked at my Github contribution map for 2025

Most of what I added are good ideas, but I have added a fair amount of bad ideas as well. Luckily library users and open source contributors - 31 so far - have worked really hard to weed these out by submitting issues and PRs so on balance what we have is a powerful easy to use.

Checkout the project on Github, leave a star ⭐, and install and try it. It is a Python library so install with pip install edgartools