Analyzing Giftify

This Christmas we unwrap GIFT's financials and insider transactions and take a peek inside the gift card economy

If you are anything like me, then you probably spent part of Christmas Eve snaking through a long checkout line in a suburban home decor store. By contrast, those among us more in tune with the desires of our loved one, will have shopped much earlier in December and placed appropriately lovely gifts under the Christmas tree. You, me and other laggards are on the hunt for gifts. Or gift cards.

Gift cards are popular. Americans alone will spend over $28 billion this holiday season on gift cards, according to the National Retail Federation. And there's one company at the heart of this gift card economy: Giftify (ticker: GIFT).

This Christmas, we'll unwrap Giftify using EdgarTools, digging through their financials and SEC filings to see what's inside.

Meet Giftify — The Gift That Keeps on Giving?

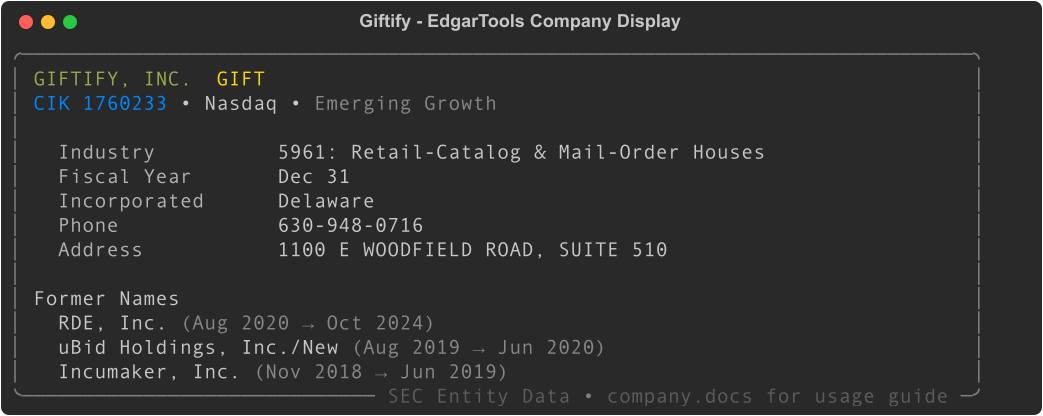

So who is Giftify? The ticker symbol GIFT belongs to Giftify, Inc., a company that operates in the gift card and restaurant deals space. They own two main businesses:

Restaurant.com — A pioneer in restaurant deals and discounts, connecting diners with local restaurants since 1999.

CardCash — Acquired in December 2023 (a Christmas acquisition!), CardCash is a secondary market for gift cards. They buy unused gift cards from consumers at a discount and resell them. It is a gift card exchange—if you got a Home Depot card but wanted Starbucks, CardCash is your middleman.

CardCash works with over 1,100 retailers including Target, Starbucks, Home Depot, and TJ Maxx.

from edgar import Company

# Finding the perfect gift company

gift = Company("GIFT")

gift

Unwrapping the Financials

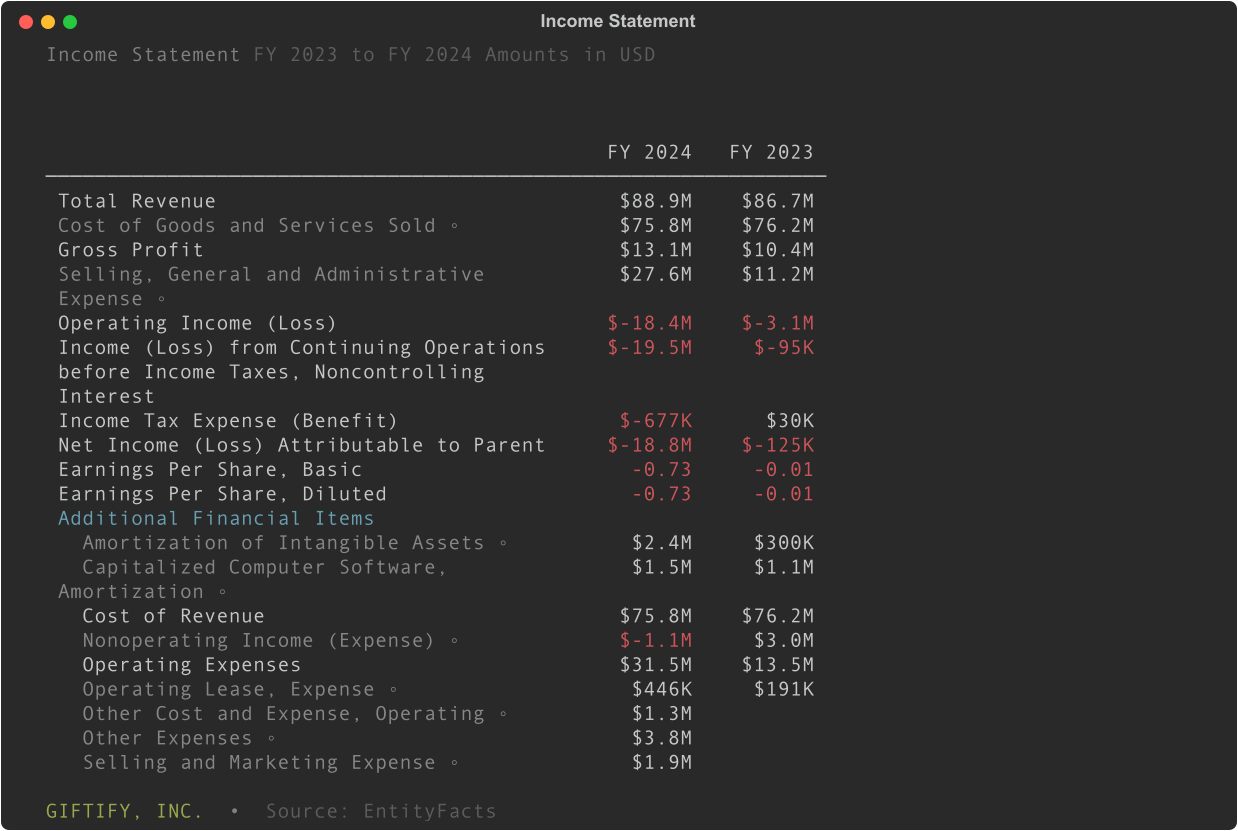

EdgarTools makes it easy to pull financial statements directly from a company. We will use the most direct route in this article using the Company Facts API. This API returns all the relevant facts collated for the company for several years. For financials, this information is aggregated from the different 10-K and 10-Q filings.

In EdgarTools we expose that directly using functions like income_statement, balance_sheet and cash_flow. Let's look at the income statement.

gift.income_statement(periods=2)

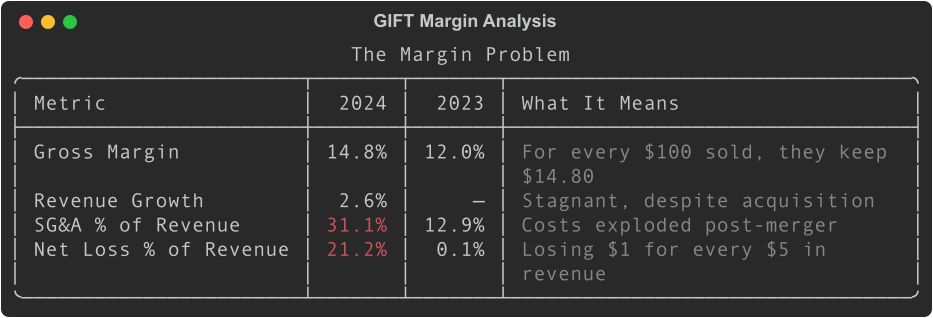

At first glance, $88.9M in revenue looks respectable and a small increase over the prior fiscal year. But let's dig deeper.

That 14.8% gross margin is the nature of gift card arbitrage—you buy cards at 85 cents on the dollar and sell at 95 cents. There's not much room for error.

The real red flag is SG&A. It jumped from $11.2M to $27.6M—a 147% increase—while revenue grew only 2.6%. The CardCash acquisition was supposed to drive growth, but so far it's mostly driven costs.

Following the Cash

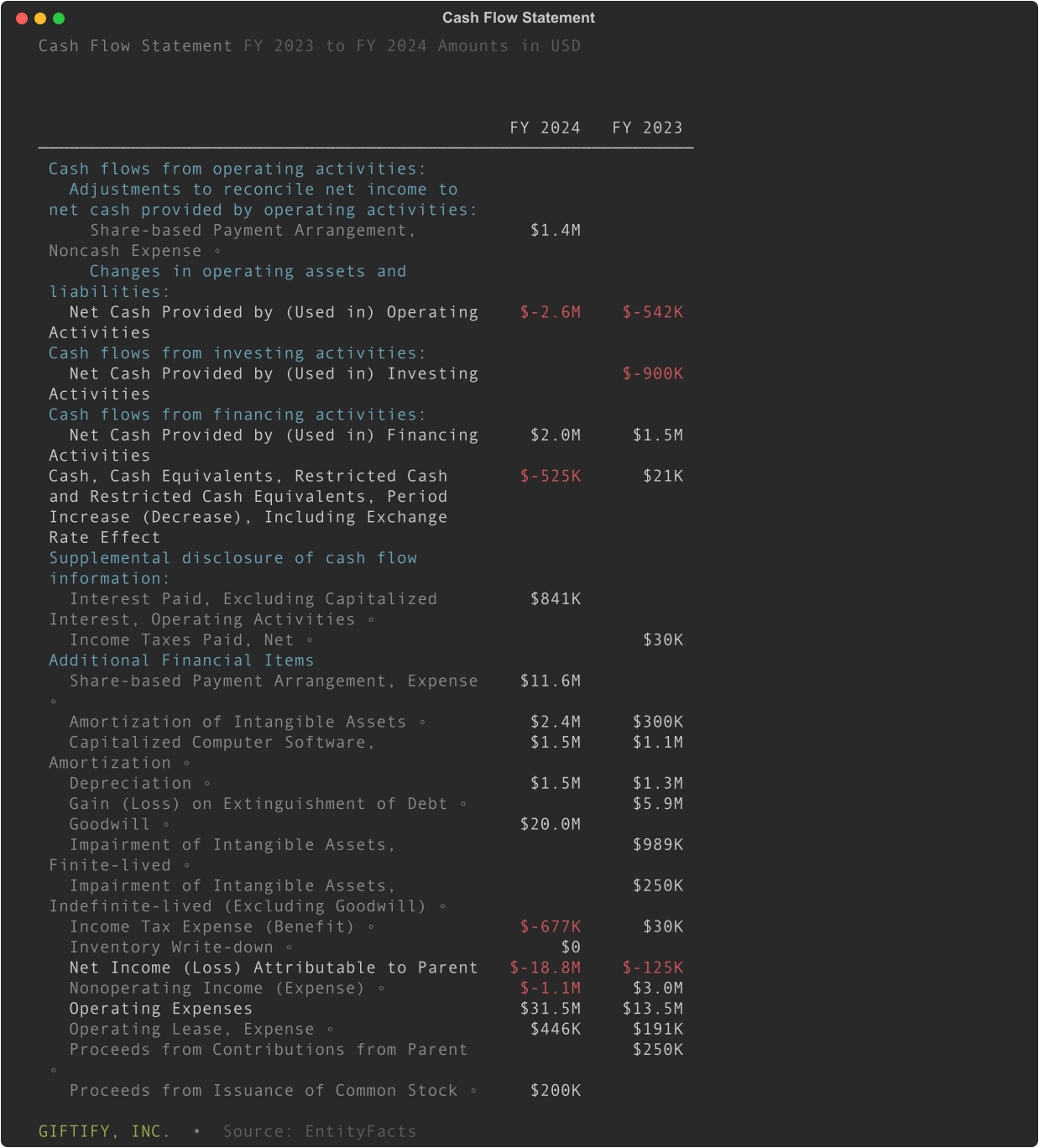

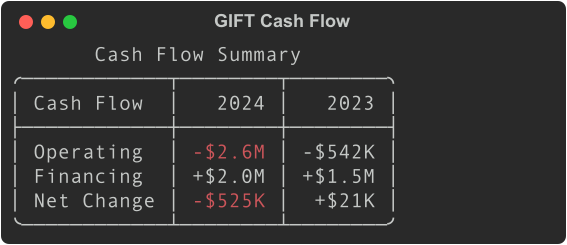

Let's check the cash flow:

gift.cash_flow

The company burned $2.6M from operations—five times worse than the prior year. They're covering the gap by raising money through stock issuance.

And here's the kicker buried in the notes: $11.6M in stock-based compensation. When a company pays employees heavily in stock instead of cash, it often signals cash is tight.

The Balance Sheet

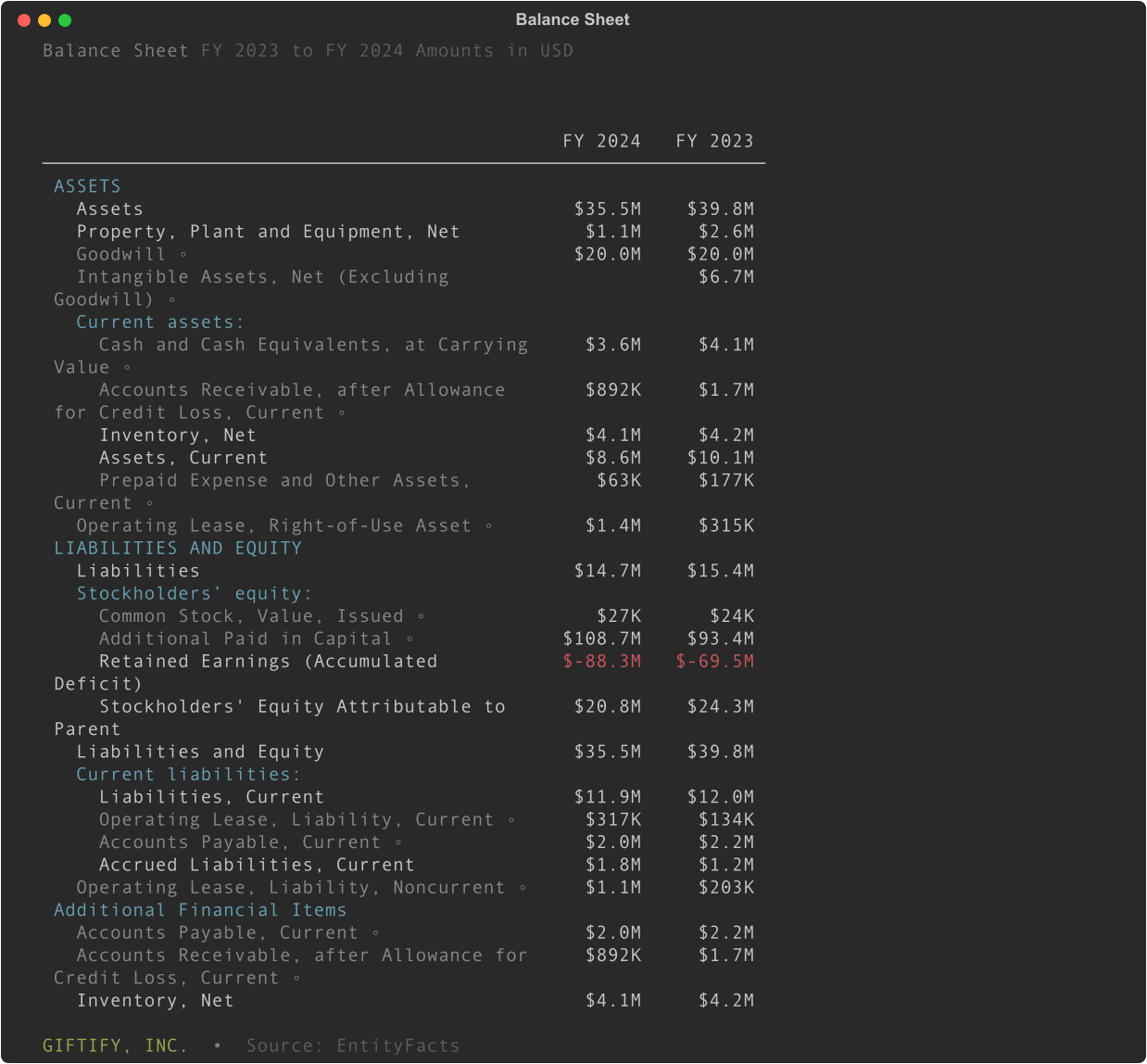

gift.balance_sheet(periods=2)

Some concerning trends:

- Cash: $3.6 down from $4.1M. At the current burn rate, that's about 15 months of runway.

- Accumulated Deficit: -$88.3 up from -$69.5M. The company has lost $88M over its lifetime.

- Additional Paid-in Capital: +$15.3M — they issued more stock to stay afloat.

- Intangible Assets: Dropped from $6.7M to near zero—likely written down.

The $4.1M in inventory is interesting. This is gift card inventory—cards bought at a discount waiting to be resold.

The Verdict

Giftify isn't a disaster, but it's a company under stress. The CardCash acquisition hasn't yet delivered the growth needed to justify the integration costs. They're burning cash, diluting shareholders, and operating in a low-margin business.

Is it a turnaround story or a slow bleed? That's the question investors need to answer.

Reading the Fine Print

Financial statements give you a snapshot, but SEC filings contain thousands of words of management commentary. We can access these by converting the 10-K filing to a TenK data object:

ten_k = gift.latest("10-K")

ten_k_obj = ten_k.obj()

# Read the business description

print(ten_k_obj.business[:500])The business section confirms what we already know: the CardCash acquisition "fundamentally changed" the company's profile. Management is optimistic about the brand awareness and experienced team they acquired.

But the risk factors section is where the real story emerges:

ten_k_obj.risk_factors[:500]And there it is, right at the top:

This is as clear a warning as you'll find in any SEC filing. The auditors looked at the books, saw the trajectory, and flagged it. Giftify is not a healthy company.

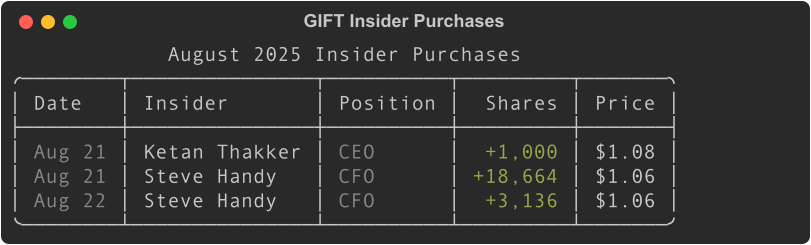

What do company insiders think?

After reading "going concern" I wanted to see what insiders were doing with their own money. When a company is struggling, executives often quietly reduce their positions. It's not illegal—they just stop buying, or let pre-scheduled sales run.

filings = list(gift.get_filings(form="4"))

for filing in filings:

form4 = filing.obj()

summary = form4.get_ownership_summary()

print(f"{summary.reporting_date}: {summary.insider_name} - {summary.primary_activity}")

print(f" Net Change: {summary.net_change:+,} shares")The Form 4s told a different story.

In August 2025, both the CEO and CFO bought stock in the open market—$24,000 worth in a 48-hour window. The only seller? A VP on a pre-scheduled 10b5-1 plan set up months before.

When the CFO, who is the person who sees the cash position every day, buys stock with his own money, that's worth noting.

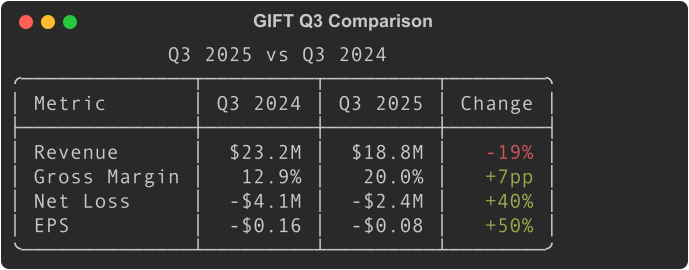

The Q3 2025 Numbers

The 10-K is backward-looking. It's December 2024 data, filed in early 2025. By the time you read a going concern warning, it's already six months old.

So I pulled the Q3 2025 10-Q:

tenq = gift.get_filings(form="10-Q")[0]

xbrl = tenq.xbrl()

income = xbrl.statements.income_statement()

income

Revenue is down—but look at the margins. Gross margin jumped from 12.9% to 20.0%. They're making more on each dollar of sales. And the losses? Cut nearly in half.

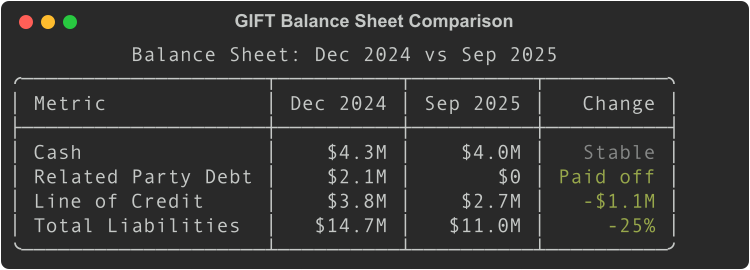

The balance sheet tells a similar story:

They paid off $2M in related party debt and reduced their credit line by $1.1M. Cash held steady at $4M instead of bleeding out.

Wrapping Up

What did we learn by unwrapping Giftify?

We learned how the 2024 10-K told one story of a company under stress, burning cash and with significant doubts of continuing as a going concern. We dug deeper to see another story of the CEO and CFO buying stock in August, with zero discretionary selling. It is a company in the middle of a turnaround, as shown in the Q3 2025 10-Q: losses cut in half, margins up 7 percentage points, debt being paid down instead of piled on.

Is Giftify out of the woods? No—they're still losing money But with hope of a better 2026 And the people closest to the number are retaining hope. That's the thing about SEC filings—there's always more to unwrap.

EdgarTools made it easy to pull income statements, balance sheets, cash flows, insider transactions, and SEC filing text—all with a few lines of Python. You are invited this holiday season to pip install edgartools and run your own analysis. And gift the Github project a star - it helps people to find it.

Happy holidays—and happy analyzing.