A cleaner view for the New Year

Ringing in the New Year with improvements with how we display dimensions in XBRL financials, more details about companies and a polished Company display

Happy 2026. We kick off the new year with a new release of Edgartools. Release 5.7.0 focuses on clarity - giving you financial statements that match what you see in SEC filings, and company information that helps you understand what you're looking at.

Cleaner Financial Statements

This release changes how dimensional data appears in financial statements.

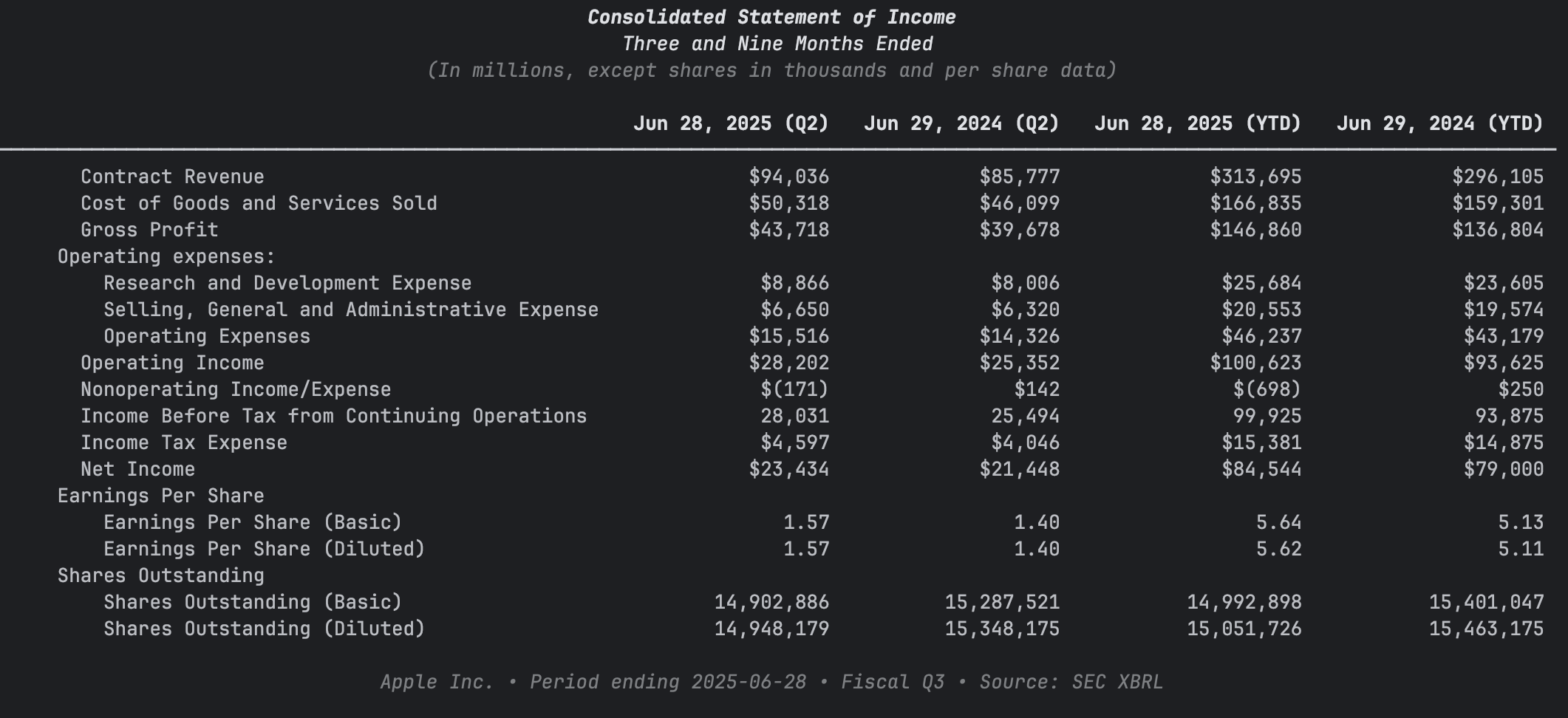

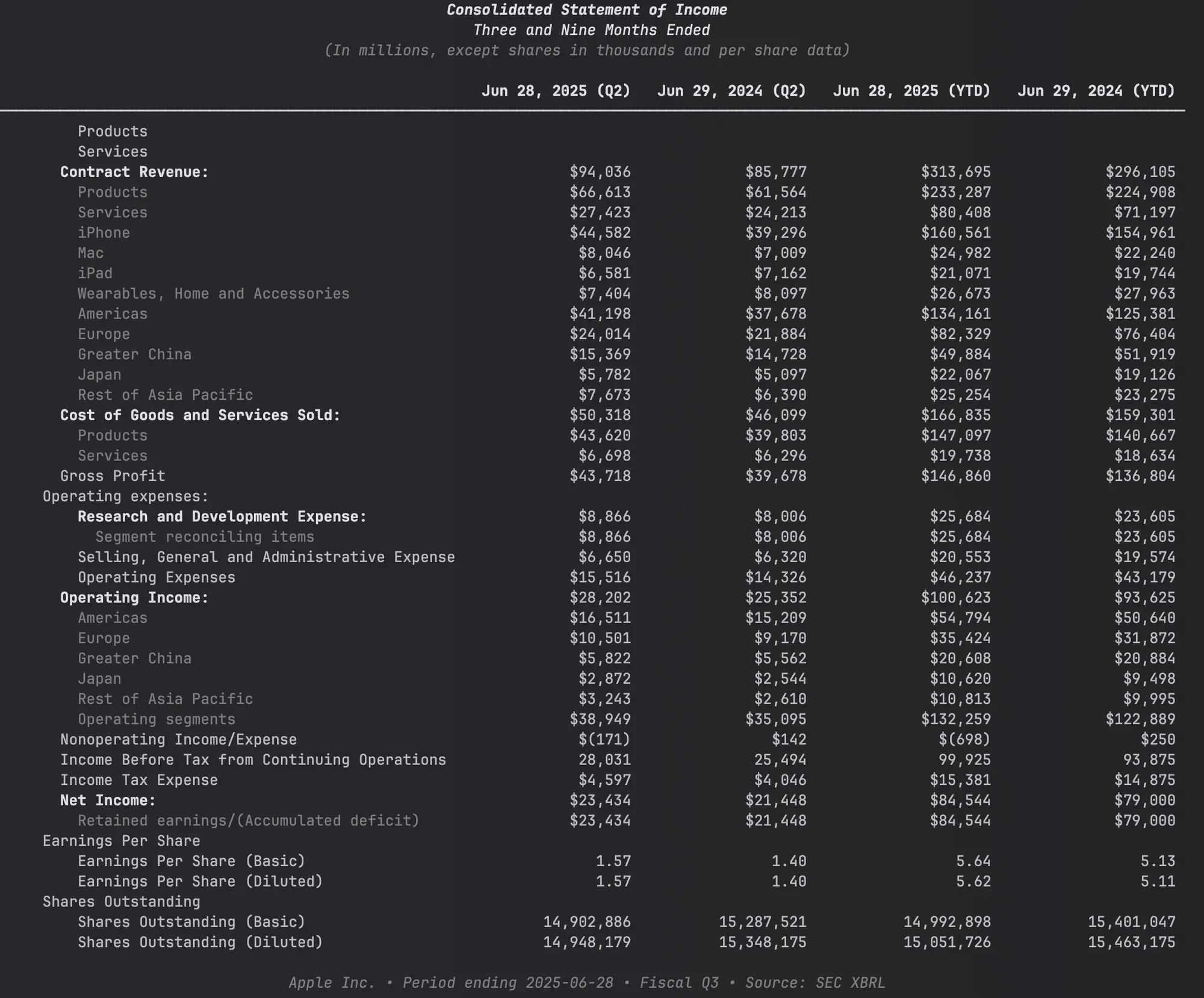

XBRL filings contain dimensional breakdowns—product segments, geographic regions, operating segments. Apple's income statement, for example, includes breakdowns by product (iPhone, Mac, iPad, Wearables) and by region (Americas, Europe, Greater China, Japan, Rest of Asia Pacific). Useful for segment analysis, but overwhelming when you just want the primary statement.

Statement methods now default to include_dimensions=False, showing only the primary statement lines that match the face of SEC filings.

filing = Company("AAPL").get_filings(form="10-K").latest()

xbrl = filing.xbrl()

# Clean view (now the default)

income = xbrl.statements.income_statement() # 25 rows, matches 10-K

The dimensional values are still there and you can access them using include_dimensions=True

This parameter is now available consistently across all statement access methods:

Migration note: If your code relies on dimensional breakdowns appearing by default, add include_dimensions=True to your statement calls. This is the only breaking change in this release.

Know Your Companies

Sugar, rum and fish. The Bank of Nova Scotia (BNS) was founded in 1832 to finance Nova Scotia's maritime trade. Ships sailed south to Jamaica bringing saltfish, timber and flour, returning with rum, molasses and sugar. So central was that trade to the bank that a branch in Kingston in 1889. Echoes of that trade remains to this day and Scotiabank now dominates as the largest bank in the Caribbean.

Edgartools will not give you any of that history.

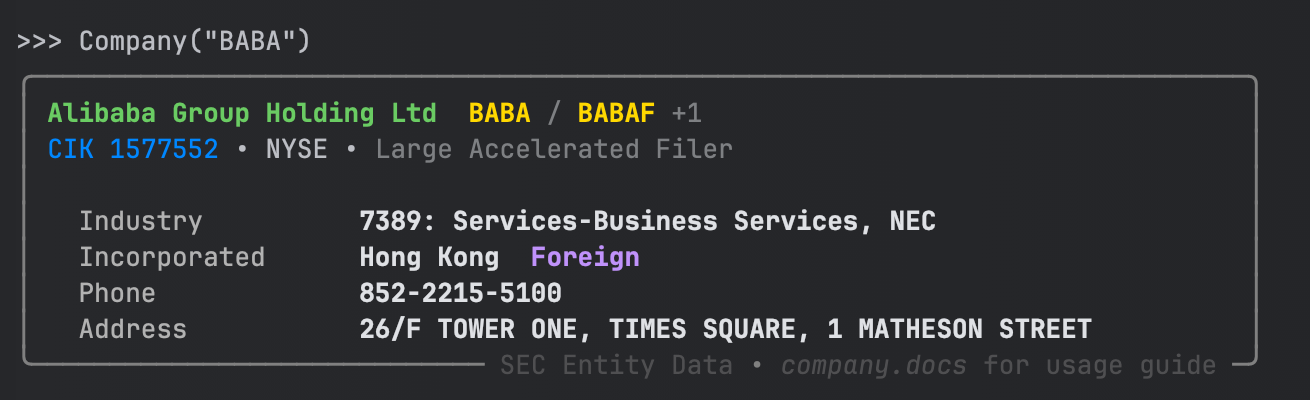

But here's a pretty Company view.

Company Classification

This includes a newbusiness_category property that was requested by users. This classifies companies automatically:

from edgar import Company

Company("AAPL").business_category # 'Operating Company'

Company("SPY").business_category # 'ETF'

Company("BX").business_category # 'Investment Manager'

Company("O").business_category # 'REIT'

Company("JPM").business_category # 'Bank'

Company("ARCC").business_category # 'BDC'Categories include: Operating Company, ETF, Mutual Fund, Closed-End Fund, BDC, REIT, Investment Manager, Bank, Insurance Company, SPAC, and Holding Company.

Three helper methods handle common filtering:

Company("SPY").is_fund() # True

Company("JPM").is_financial_institution() # True

Company("AAPL").is_operating_company() # TrueThis makes screening straightforward:

tickers = ["AAPL", "SPY", "JPM", "MSFT", "VTI", "BRK-B"]

operating = [t for t in tickers if Company(t).is_operating_company()]

# ['AAPL', 'MSFT', 'BRK-B']Foreign Company Detection

Companies incorporated outside the United States have different filing requirements. Foreign private issuers file 20-F instead of 10-K.

Company("BABA").is_foreign # True (Cayman Islands)

Company("BABA").filer_type # 'Foreign'

Company("RY").filer_type # 'Canadian'

Company("AAPL").filer_type # 'Domestic'Upgrading

To get these changes install the latest version of edgartools

pip install -U edgartoolsThe one migration step: if you need dimensional breakdowns in financial statements, add include_dimensions=True to your statement calls.

Looking Ahead

These changes set the foundation for smarter defaults throughout the library. Fund analysis could use appropriate metrics automatically. Foreign company workflows could adapt to 20-F patterns. We're exploring these for future releases.

Edgartools is a popular open source library for working with SEC filings. Visit the Github Repo and leave a star if you find it useful.